In 2018 some individual tax rates have been slashed 2 for three slabs Chargeable Income Bands 20001-35000 35001 50000 50001 -70000 will now be taxed 3 8 14 respectively. On the First 5000.

Defense Finance And Accounting Service Civilianemployees Civilian Permanent Change Of Station Pcs Civilian Pcs Entitlement Guide Relocation Income Tax Allowance Rita

20182019 Malaysian Tax Booklet Personal Income Tax.

. Criteria on Incomplete ITRF. Basic supporting equipment for disabled self spouse child or parent 6000. Corporate tax rates for companies resident in Malaysia is 24.

Individual Life Cycle. Internet Explorer 110 Microsoft Edge Mozilla Firefox 440 Google Chrome 460 atau Safari 5. Live budget 2019 malaysia updates highlights.

A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with a designated company engaged in a qualified activity in that specified. Assessment Year 2018-2019 Chargeable Income. 12092019 2018 individual income tax rates make sure youre logged in before you proceed with these steps.

Based on this table there are a few things that youll have to understand. Long gone are the days of filling in paper forms doing all kinds of math in order to. Offences Penalties Failure to furnish Income Tax Return RM200 to RM20000 or imprisonment or both on conviction or 300 of tax payable in lieu of prosecution Failure to furnish Income Tax Return for 2 YAs or more RM1000 to RM20000 or imprisonment or.

A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum of 30 on chargeable income exceeding RM2000000 with effect from YA 2020. An individual who has income from non-business sources is required to fill out the Form BE. Every taxpayer is entitled to a default relief of RM9000.

That is why we have made a quick guide to file your income tax 2018. Offences Fines and Penalties. Self rebate 40000 31500 limited to1.

Calculations RM Rate TaxRM 0 - 5000. Basic supporting equipment for disabilities self spouse children or parents Covers equipment to aid with disabilities including wheelchairs and artificial legs. Long gone are the days of filling in paper forms doing all kinds of math in order to calculate our taxes and rushing to the irb inland.

Monthly Tax Deduction 2018 for Malaysia Tax Residents optionname00. Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except. 13 September 2018 Page 2 of 14 Tax on the balance XX of chargeable income XX XX.

Self and dependents. Introduction Individual Income Tax. Similarly those with a.

For assessment year 2018 the IRB has made some significant changes in the tax rates for the lower income groups. Also taxes such as estate duties earnings tax yearly wealth taxed or federal taxes do not get levied in Malaysia. Under the tax law those who stay more than 182 days in Malaysia are considered residents.

Medical Expenses for Parents OR Parent Limited 1500 for only one mother Limited 1500 for only one father 5000 limited OR 3000 limited 3. Dimaklumkan bahawa pembayar cukai yang pertama kali. Those who stay less than that are non-residents and will be taxed differently.

LIVE Budget 2019 Malaysia Updates Highlights. Agreement with Malaysia and Claim for Section 133 Tax Relief HK-10 InstalmentsSchedular Tax Deductions Paid 31. The personal income tax with the highest rate is only 27.

Malaysia Personal Income Tax Guide 2018 YA 2017 Calculating personal income tax in Malaysia does not need to be a hassle especially if its done right. Offences under the Income Tax Act 1967 and the penalties thereof include the following. Malaysia Personal Income Tax Rate.

43 For a resident individual income tax shall be charged upon the chargeable income of the individual at the scale rate as specified in Schedule 1 of the. Understanding tax rates and chargeable income. Special tax rates apply for companies resident and incorporated in Malaysia with an ordinary paid-up share.

The biggest change weve seen over the years is the increasing number of people moving from manual tax filing to e-filing. Does not cover spectacles and optical lenses. A non-resident individual is taxed at a flat rate of 30 on total taxable income.

Personal income tax in Malaysia is charged at a progressive rate between 0 28. Microsoft Windows 81 service pack terkini Linux atau Macintosh. 12 rows Income tax rate Malaysia 2018 vs 2017.

The Simple PCB calculator takes into account of RM2000 special tax relief limit that capped at income RM8000mth. 62018 INLAND REVENUE BOARD OF MALAYSIA Date of Publication. Return Form RF Filing Programme For The Year 2021 Amendment 42021 Return Form RF Filing Programme For The Year 2022.

Schedule On Submission Of Return Forms RF Contoh Format Baucar Dividen. 1 Corporate Income Tax 11 General Information Corporate Income Tax. Non-resident individuals pay tax at a flat rate of 30 with effect from YA 2020.

50 income tax exemption on rental income of residential homes. Accurate and easy calculation to Malaysian tax payers to calculate PCB that covers all basic tax relieves such as individual. Return Form RF Filing Programme.

Chargeable income is your taxable income minus any tax deductions and tax relief. First of all you have to understand what chargeable income is. 20182019 Malaysian Tax Booklet 21 year and in any 3 of the 4 immediately preceding years he was in Malaysia for at.

Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any information obtained from this website. Its faith in them to assess and settle their income tax with the introduction of the Self Assessment System commencing from. Types of Contribution allowed for Personal Tax Relief Individual Relief Types Amount RM 1.

Not only are the rates 2 lower for those who has a chargeable income between RM20000 and RM70000 the maximum tax rate for each income tier is also lower. Here are the tax rates for personal income tax in Malaysia for YA 2018. Read on to learn about your income tax rate and filing your 2018 personal income tax with LHDN.

Pengesahan ini boleh didapati melalui perkhidmatan ezHASiL di httpsezhasilgovmy atau di cawangan-cawangan LHDNM. Self Dependent 9000 2.

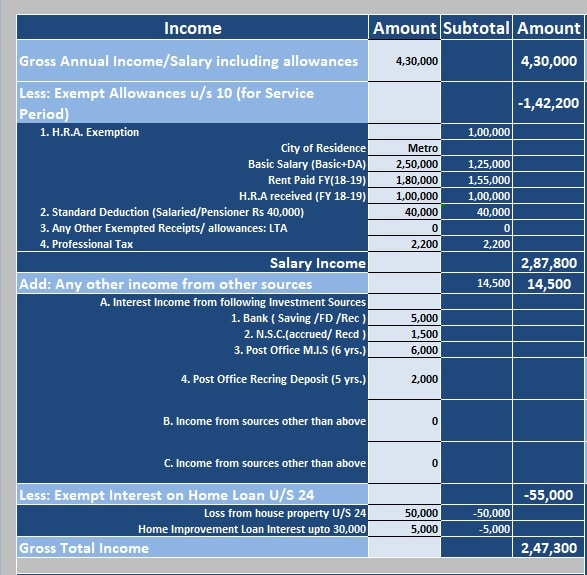

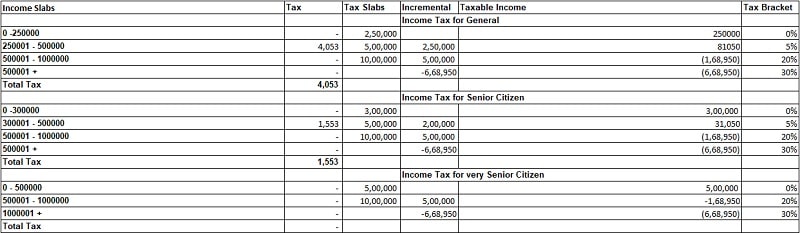

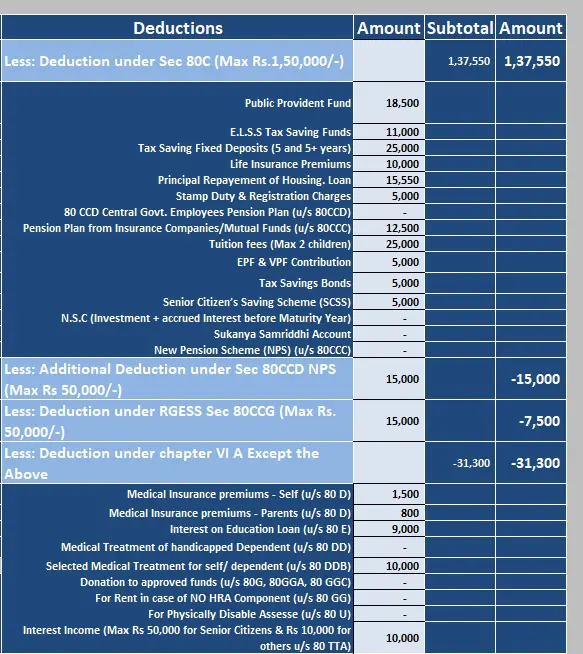

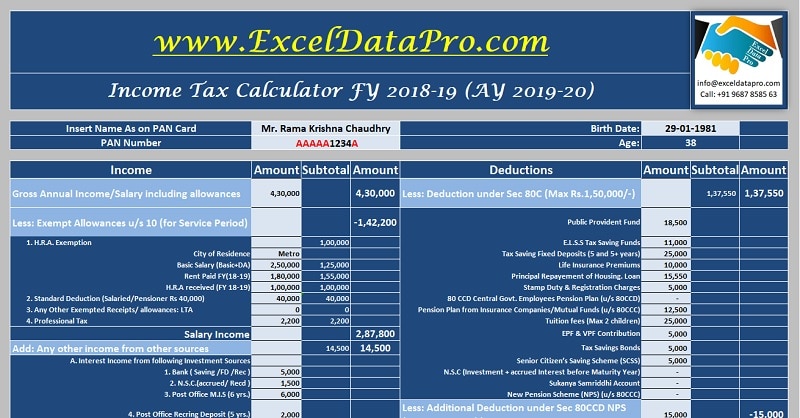

Download Income Tax Calculator Fy 2018 19 Excel Template Exceldatapro

The Purpose And History Of Income Taxes St Louis Fed

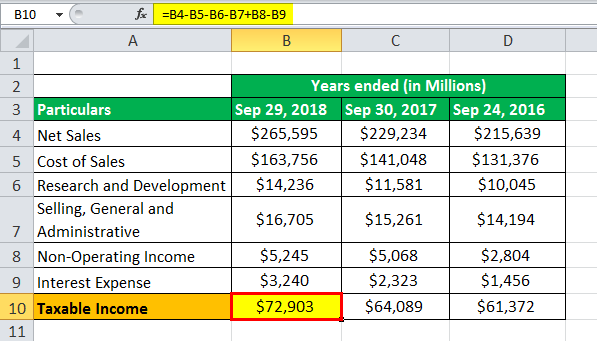

Effective Tax Rate Formula Calculator Excel Template

How To Calculate Income Tax In Excel

Income Tax India Statistics Indpaedia

Taxable Income Formula Examples How To Calculate Taxable Income

Deferred Tax Asset Journal Entry How To Recognize

Download Income Tax Calculator Fy 2018 19 Excel Template Exceldatapro

Download Income Tax Calculator Fy 2018 19 Excel Template Exceldatapro

Taxable Income Formula Examples How To Calculate Taxable Income

Taxable Income Formula Examples How To Calculate Taxable Income

New Irs Announces 2018 Tax Rates Standard Deductions Exemption Amounts And More

Download Income Tax Calculator Fy 2018 19 Excel Template Exceldatapro

Completing Form 1040 And The Foreign Earned Income Tax Worksheet

10 Things To Know For Filing Income Tax In 2019 Mypf My

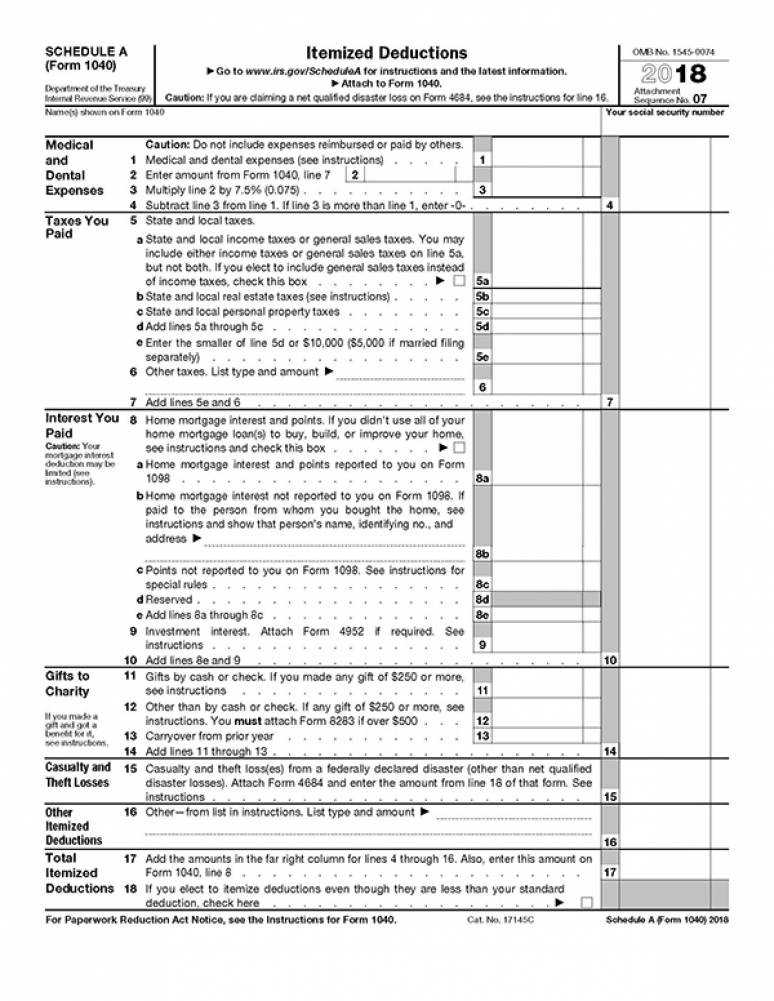

2018 Irs Tax Forms 1040 Schedule A Itemized Deductions U S Government Bookstore

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)